In 2025, Environmental, Social and Governance (ESG) is not just a regulatory formality — it is a dynamic risk factor that financial institutions cannot afford to overlook. Reputation, portfolio integrity, and compliance now hinge on a firm’s ability to detect ESG exposure before it surfaces in headlines or audit reports.

Yet, many institutions still rely on static ESG ratings and backward-looking disclosures — tools that were never designed to keep up with the speed, complexity, and opacity of today’s ESG landscape.

That’s where AI-native tools like OneNexus come in.

At the centre of this shift are two powerful ideas: uncovering hidden ESG risks and proving every insight with traceability.

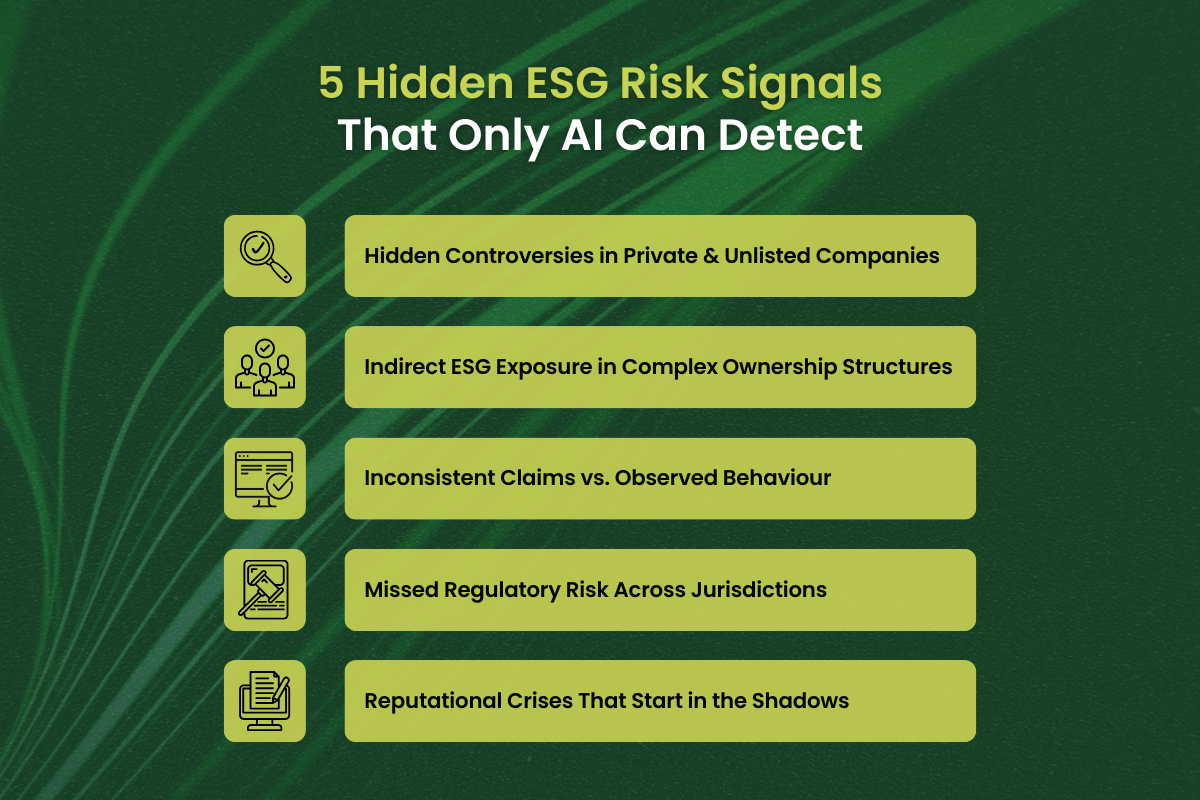

This article explores five ESG blind spots most institutions miss and how OneNexus Traceability Engine turns fragmented signals into source-backed decisions you can trust.

At the core of this transformation is the OneNexus Traceability Engine — a system designed to not only surface ESG risks, but to trace them back to their origin.

Every signal identified by OneNexus; whether it’s a media mention, a regulatory misalignment, or a questionable ESG claim — is backed by transparent source data. That means compliance teams can go from “what happened” to “where it came from” in seconds.

Unlike black-box scoring tools, OneNexus Traceability Engine ensures:

Today’s financial institutions operate across jurisdictions, asset classes, and industries. But the ESG risks embedded in those exposures are increasingly:

To surface these signals, you need more than ratings. You need ESG intelligence.

Many private portfolio companies, especially in emerging markets, do not publish formal ESG disclosures. But that does not make them low-risk.

AI systems like OneNexus has the capability to scan and read:

…to detect emerging ESG red flags long before they appear in structured databases.

Risk is not always direct. It can sit in a minority-owned joint venture, a second-tier supplier, or a legacy subsidiary still linked to your portfolio.

Most ESG tools stop at the primary entity. However, OneNexus does not. It maps multi-tier relationships and flags ESG violations even when they originate two steps removed.

A polished ESG report does not guarantee alignment with reality. In fact, some of the biggest greenwashing cases stem from companies saying all the right things but failing when it comes to delivering the data analysis.

OneNexus cross-references corporate claims with:

This helps compliance teams detect discrepancies, and ensures that reporting remains grounded in traceable evidence.

With Corporate Sustainability Reporting Directive (CSRD), Sustainable Finance Disclosure Regulation (SFDR), International Sustainability Standards Board (ISSB) gaining traction, ESG rules are multiplying fast — and so are the penalties for non-compliance.

OneNexus keeps your team informed with:

A tweet. A local blog post. A whistleblower complaint.

Many ESG controversies start in places your systems are not watching. OneNexus monitors unstructured media and sentiment channels to catch the early signs, before reputational damage becomes irreversible.

OneNexus is not a generic ESG overlay. It was built from the ground up with financial institutions in mind — the structures they manage, the regulators they answer to, and the scale at which they operate.

It delivers:

In short, OneNexus doesn’t just help you track ESG. It helps you prove it — to regulators, investors, and internal stakeholders alike.

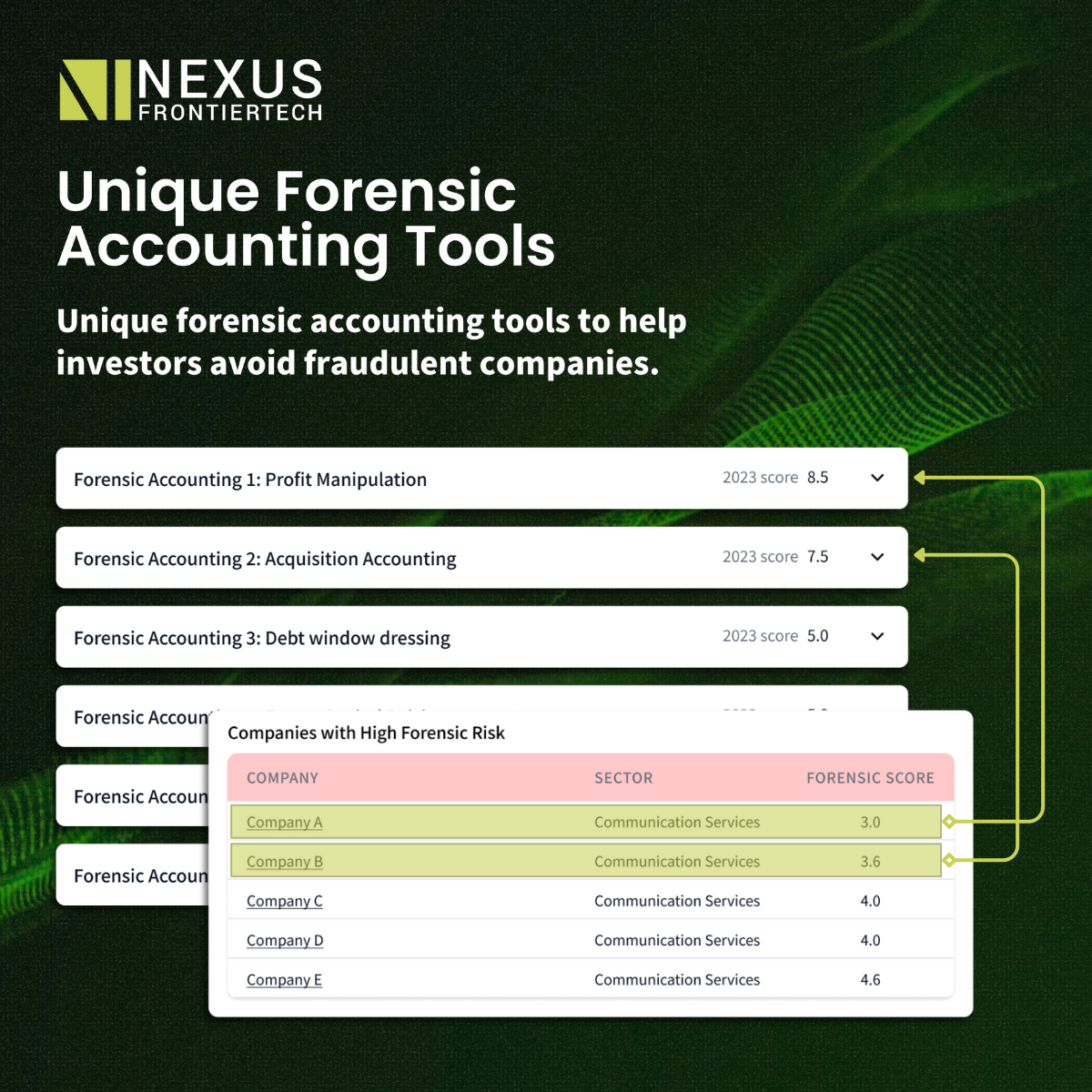

Most ESG ratings provide a score. OneNexus provides something more valuable: traceable, explainable insight that connects every metric back to its source.

Take financial statement analysis as an example. With OneNexus, ESG-related signals are not just extracted — they are fully traceable. You can hover over any data point to see exactly where it came from, how it was transformed, and who reviewed it.

This level of transparency is built into the workflow:

This is not just about owning a clean and structured data. It is about giving ESG compliance teams full confidence in the data that they are analysing and reporting, especially when data integrity and explainability are essential.

This is not just helpful for internal purposes. It is essential for:

OneNexus turns ESG from a black box into a transparent system of record — where every action is traceable and every claim is verifiable.

That’s what OneNexus delivers.

Explore how OneNexus helps financial institutions uncover ESG risk in real time:

Learn more at https://onenexus.ai/

Level 39, One Canada Square,

Canary Wharf, London

E14 5AB

6 Battery Rd, #03-62,

The Work Project @ Six Battery Road

Singapore 049909

Studio 1006, Dreamplex Thai Ha, 10th floor 174 Thai Ha Str, Dong Da Ward

Hanoi 100000, Vietnam

Otemachi Building 4th Floor

Otemachi 1-6-1, Chiyoda

Tokyo 100-0004, Japan