Environmental, Social and Governance (ESG) risk management is no longer a peripheral concern—it has become a core pillar of corporate and financial strategy. However, many organisations still rely on outdated ESG monitoring frameworks that are reactive, inconsistent, and unable to cope with the scale and complexity of modern data environments.

At Nexus FrontierTech, we believe the answer lies in AI-powered agents. Developed within the OneNexus platform, these intelligent modules enable compliance teams to assess, track, and respond to ESG risks in real time—ensuring businesses remain not only compliant, but strategically ahead.

Despite increased investment in ESG initiatives, legacy risk monitoring tools fall short in several key areas:

Recent regulatory developments underscore the need for more robust ESG risk management:

AI agents trained for ESG compliance can address these challenges by introducing speed, scale, and foresight:

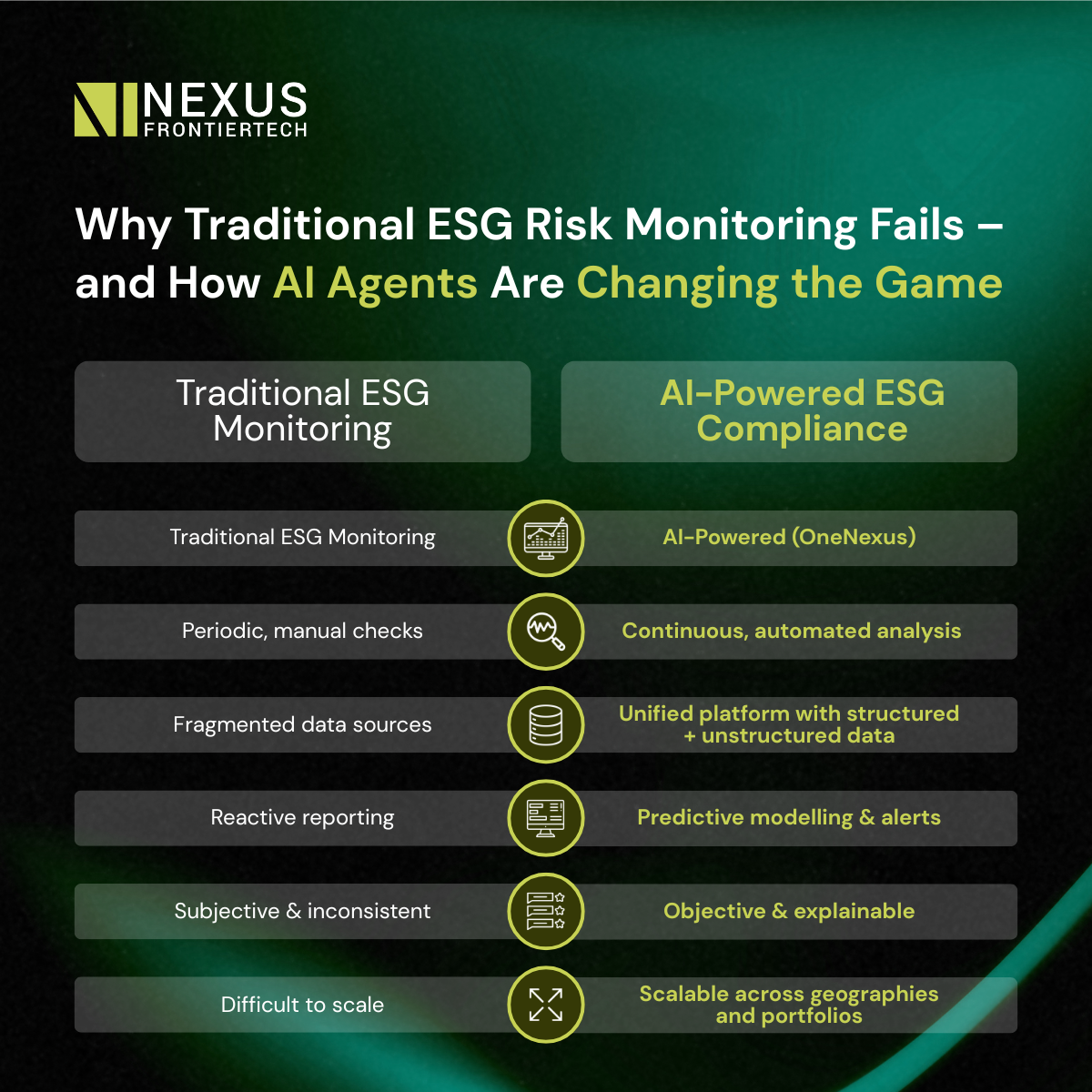

Legacy ESG tools vs AI-powered monitoring at a glance.

Explainable Outputs: With audit trails and justifications built into each action, AI-based assessments are transparent and regulator-ready.

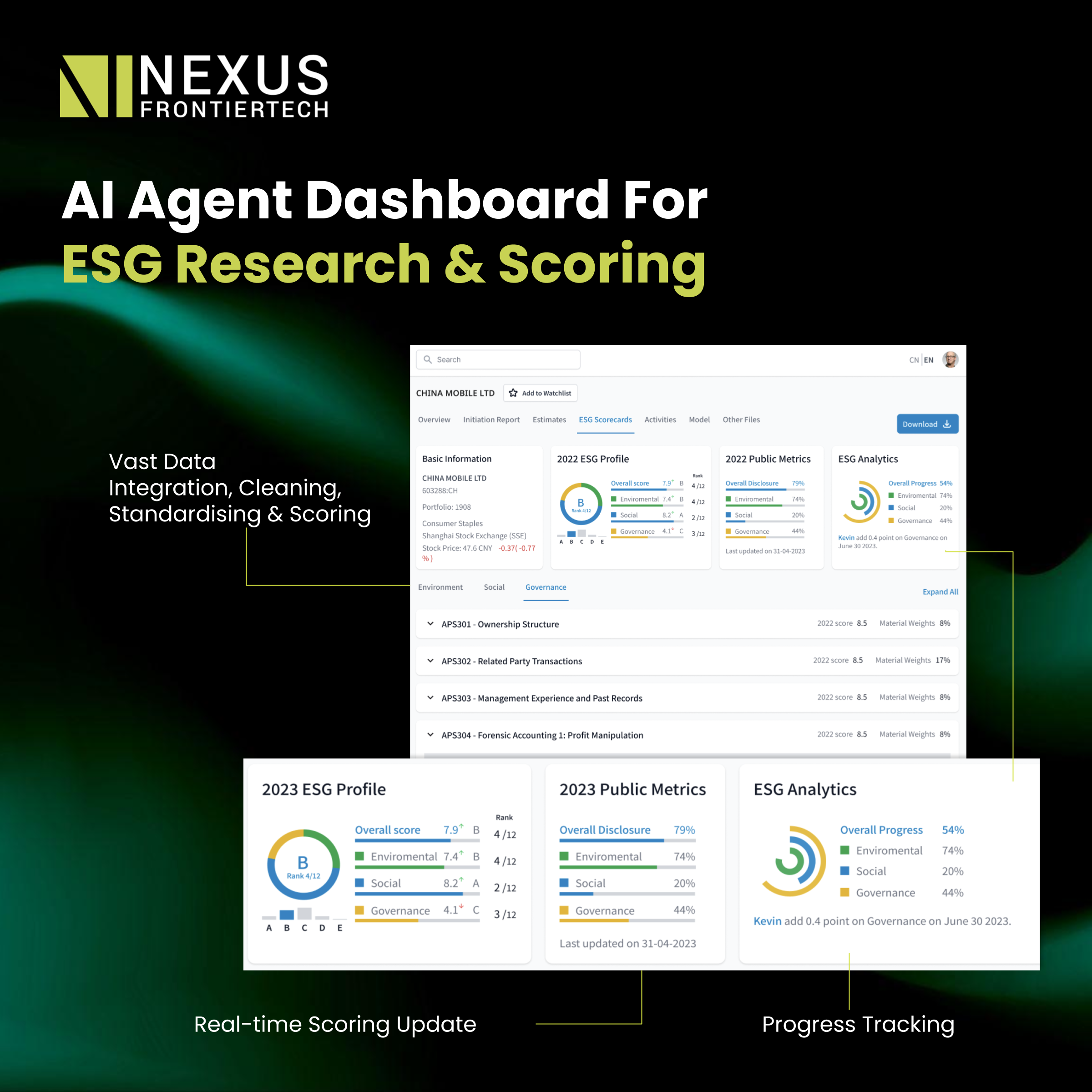

OneNexus combines AI-powered ESG risk monitoring with a modular architecture built for scale:

ESG insights visualised within the OneNexus platform.

As ESG compliance becomes increasingly complex and critical, traditional monitoring methods are no longer sufficient. AI agents not only automate what traditional systems can no longer handle but also empower organisations to lead with insight and confidence.

Discover how OneNexus can future-proof your ESG risk framework. Request a demo today: https://onenexus.ai

Level 39, One Canada Square,

Canary Wharf, London

E14 5AB

6 Battery Rd, #03-62,

The Work Project @ Six Battery Road

Singapore 049909

Studio 1006, Dreamplex Thai Ha, 10th floor 174 Thai Ha Str, Dong Da Ward

Hanoi 100000, Vietnam

Otemachi Building 4th Floor

Otemachi 1-6-1, Chiyoda

Tokyo 100-0004, Japan