For the financial sector in particular, AI has been strongly utilised in credit risk management. This function calculates a borrower’s credit score, which then evaluates their probability of default. Given that credit risk is one of the largest risks to a financial institution, more and more firms are seeking solutions that can address them. This is also partly due to their increased exposure to risk, either through the expansion of their product range or the increased complexity of their operations.

In this article, we’ll discuss the benefits of AI, the upcoming changes regarding AI in the financial industry and whether AI will be the answer to credit risk management.

Benefits of AI in credit risk management

Credit risk management has always been a challenging process. Banks need to extract information from the borrowers’ financial statements, which are often case-specific and prone to errors. After inputting all this information into their internal system, banks will calculate credit scores using their own Credit Scoring model.

In the current age of digital transformation, data is becoming more readily available, both internally and externally. This opens up an opportunity for more accurate credit scoring, but also creates challenges concerning handling this data volume. Banks need to adopt new credit risk management frameworks to handle this large amount of data in a short period of time. This is where AI can make a difference, providing banks with benefits we’ll now explore.

Speed up time to credit decisions

The processes of credit risk management are often time-intensive. For instance, each financial spread takes anywhere from a few hours to a few days to complete, consuming credit analysts’ valuable time. Additionally, if there are any mistakes identified during the review process, even more time will be spent to address them.

Financial institutions can use AI to automatically extract information from financial statements, which helps significantly reduce loan or credit processing time. Also, with AI, complex calculations can be made automatically without human supervision, eliminating the needs for manual calculation.

These time-savings also lead to another benefit for AI in credit risk management. With manual and repetitive tasks no longer a part of the job, employees can spend time performing other tasks. These tasks are likely to be more valuable to the financial institution, and likely to be more rewarding to their employees.

Improve accuracy of credit scoring

Inaccurate assessment of a borrower’s credit score can cost financial institutions sizeable losses. Banks need to find ways to minimise this risk, specifically by adopting smarter models of credit assessment.

However, it is often misunderstood that in order to speed up credit assessment, banks need to compromise on accuracy. This is where Artificial Intelligence (AI) and Machine Learning (ML) can change this view, by improving speed yet maintaining a similar level of accuracy.

These technologies can learn from complex datasets in order to fine-tune their processes. Thanks to the Human-in-the-loop AI model, humans can evaluate an AI system’s work and make changes to the results – allowing the system to learn and improve over time. We also wrote a blog article on this topic, about how this model is gaining popularity.

Additionally, AI can also make changes to a borrower’s credit score as their real-time data changes. This will provide banks with a dynamic, up-to-date risk profile of borrowers to make decisions accordingly.

Meet regulatory compliance

Meeting regulatory compliance of leveraged transactions requires banks to ensure data are accurate and transparent. This requirement translates into banks doing their due diligence when providing loans and other investments.

This degree of transparency can be facilitated by AI applications, ones that can process high-quality data to reduce data bias. AI’s ability to not only adopt but also analyse these data sources is crucial to ensuring accurate credit scores, improving credit risk detection and engaging better with customers.

The future of AI in credit risk management

There are many benefits associated with AI in credit risk management. But how impactful are they in the future? Will there be any challenges that financial institutions need to address when adopting AI? All these questions will be answered in the next section.

Trends

Amidst the uncertainty caused by the Covid-19 pandemic, Lendt and Brighterion collaborated on a study to learn how lenders are using AI to manage credit risk, and what their plans are in the near future.

The key takeaway is that 50% of financial institutions and lenders are currently utilising AI for credit risk management, while 25% are planning to do so in the next 2-5 years. However, these lenders are not all on board with the idea, as 26% of them showed concerns about the difficulties of AI implementation.

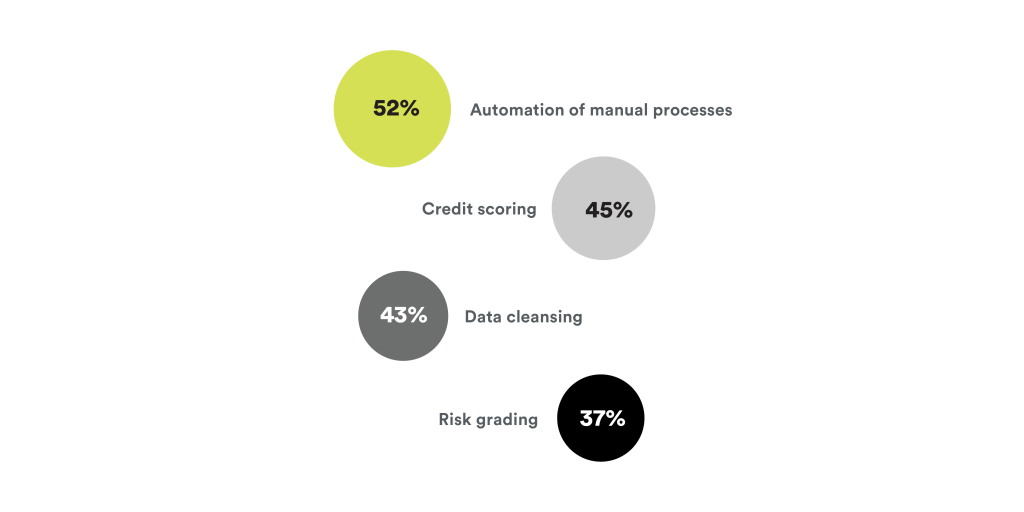

Through another survey conducted by the Global Association of Risk Professionals (GARP) and analytic leader SAS in 2018, credit scoring is amongst the top 6 current AI use cases. Standing at 45%, it is clear that it is being heavily utilised in AI credit scoring, followed by 37% of Risk grading – a financial function that oversees credit scoring.

Challenges

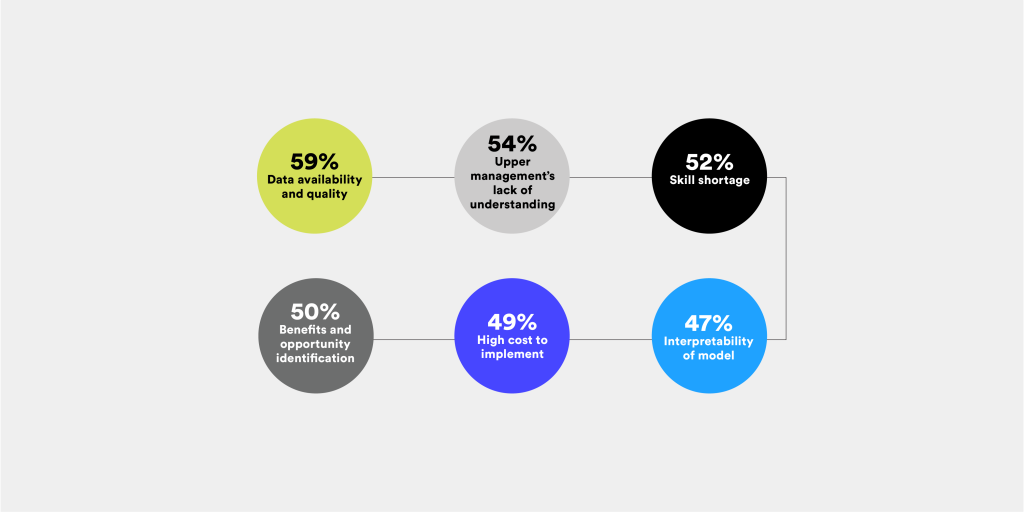

Through the same research, many respondents have identified the challenges that they face when adopting AI. These challenges extend beyond the field of credit risk management, as AI has a significant effect on risk management itself.

It is unsurprising that data availability and skill shortage are two major challenges to the adoption of AI, coming from such a new technology. The high investment fees and difficulties in identifying the right opportunities for implementation are also holding back AI in credit risk management, at 49% and 50% respectively.

A survey conducted by the Hong Kong Monetary Authority in 2019 also brings up similar points, as they collect answers from financial institutions in the country. It is shown that the three biggest AI risks identified by banks are:

- Lack of expertise or resources

- Biased decisions made by the Machine Learning models

- Lack of quality data.

Conclusion

The financial industry is changing. Digital transformation is happening at a rapid pace, with AI fast becoming a major player in this change. Its abilities to process huge volumes of data with accuracy and speed are especially important to many of finance’s processes.

Through the benefits, challenges and trends discussed in this article, it is clear that even though this change will not happen overnight, it is inevitable. AI will become what many finance and technology experts believe, an industry-changing tool, for finance and credit risk management.