The Asset & Wealth Management industry is still in the early stages of Artificial Intelligence (AI), but with the rapid development of the digital landscape, asset & wealth managers are increasingly deploying AI to get ready for new challenges and opportunities that lie ahead.

Asset and wealth managers now face many common problems in areas of operational inefficiency, inadequate data to create investment strategy and profit growth. According to the report “AI and the Modern Wealth Manager”, a significant percentage (93%) of asset & wealth managers say AI will play a role in the future of their practice. Almost a third of asset & wealth managers say AI has the ability to transform wealth management for the better, and many are already seeing results from these technologies in portfolio returns (71%), client communication (71%) and overall client experience (68%).

Below are some of the trends to watch for in 2020:

In asset and wealth management firms, inefficiency remains a challenge in daily operational tasks due to long and manual processes. One of the AI trends in asset and wealth management is the application of intelligent document processing to validate client data and received documents. This AI-powered solution can eliminate complex processing as well as automate regulatory compliance processes to enhance relationship management and client experience.

One example can be found in the client onboarding process after a prospect signals his or her willingness to invest. An AI-augmented real-time onboarding system collects information quickly from clients digitally, answers questions in real-time and clarifies information gaps on the spot. Some examples are the following:

Most portfolio managers rely on Excel (indicated by 95% of portfolio management respondents) and desktop market data tools (indicated by 75% of portfolio management respondents) for their investment strategy and processes (CFA Institute, 2019). However, data analytics are necessary for asset and wealth management firms to have more insights on clients and advisors. Hence, AI can be applied to sentiment analysis to create investment insights.

Using AI, a large amount of automated data analysis can help asset and wealth management professionals make deeper datasets without tons of quantitative analysis staff. Asset and wealth management teams can track and analyse the sentiment of the market in real-time. Moreover, AI can help professionals gain an insightful understanding of customer behaviors to assist in financial product marketing, customer segmentation and customer services. Greg Davies, Head of Behavioural Science at Oxford Risk commented on his experience: “AI can dynamically process that information in real-time and do all the data juggling to present the advisor with the most accurate, holistic portrait the firm has of the client at that moment.”

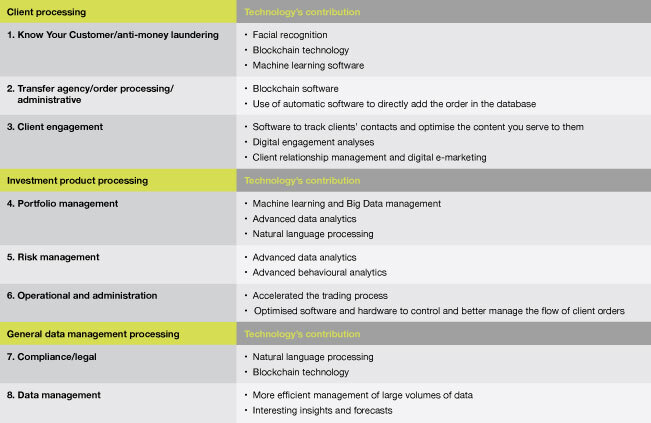

Technology & Operations in Asset & Wealth Management, PWC

The shift in revenue strategy of investment management firms in 2020 is the foundation for the development of AI-based tool adaptation to diversify the services and holistic management options. The amount of assets under management has increased faster than revenues have, and managers have been feeling the pressure (Asset & Wealth Management Revolution: Pressure on profitability, PwC 2019). Fierce competition of management fee prices in this industry is forcing firms to apply technology to reduce operational costs and expend more effective services for clients.

One example is the emergence of direct indexing, which emulates exchange traded-funds (ETFs). Investors can purchase the ETFs while the fees for them are low. The application of AI in this process helps investors choose the adequate funds, creating higher profitability. Below are some basic types of artificial intelligence ETFs:

In conclusion, AI is rapidly evolving and continues to impact the asset & wealth management industry. To remain competitive, firms need to watch and adapt technology trends to reduce their costs while increasing their revenue stream.

Not sure where to start on your Intelligent Automation Journey? Take a look at Nexus FrontierTech’s AI solutions or get in touch to have one of our representatives reach out for a free consultation.

Level 39, One Canada Square,

Canary Wharf, London

E14 5AB

6 Battery Rd, #03-68,

The Work Project @ Six Battery Road

Singapore 049909

Studio 1006, Dreamplex Thai Ha, 10th floor 174 Thai Ha Str, Dong Da Dist

Hanoi 100000, Vietnam

Remote Teams