Well-implemented AI solutions can enable asset management firms to ensure compliance, acquire new kinds of value and innovate operating activities.

Due to the continuous changing of various regulations, policies and frameworks, traditional methods of risk analysis can no longer handle the ever-increasing volume of data. As a result, financial institutions must swiftly adjust their strategies in order to ensure compliance. For example, many have expanded their headcount to process and report on the huge amounts of daily updated risk data.

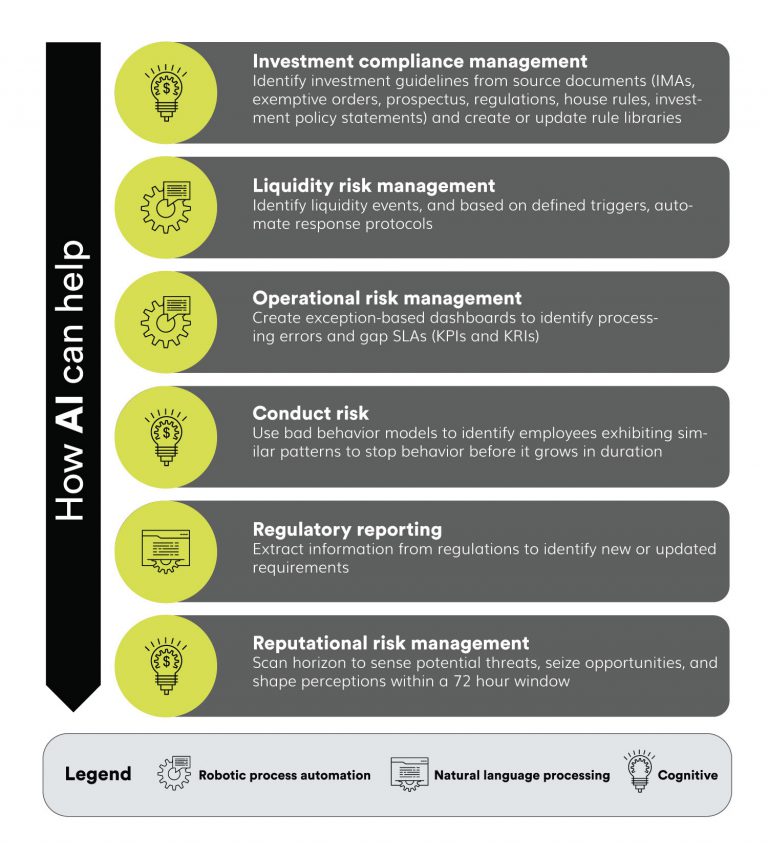

AI and machine learning applications have proven to increase effectiveness and efficiency and address challenges and issues with which humans have to deal during regulatory compliance programs. AI can help identify and manage risks in a vast pool of data.

AI is practical because it is capable of automating consumption and analysis of data, reducing administrative activities and augmenting monitoring and decision-making. AI can be considered as a game-changer for compliance management in asset management firms.

Source: Artificial intelligence: The next frontier for investment management firms (Deloitte, 2019)

The benefits of AI and machine learning in compliance systems are continuously being discussed. However, at the present, there are at least 5 advantages of AI implementation for asset management firms to take into consideration.

1. False positives reduction

Financial institutions are experiencing large volumes of false positives that their conventional, rule-based compliance alert systems are generating. In 2018, Forbes reported that with false positive rates sometimes exceeding 90%, something was awry with legacy compliance processes. These false alarms must be reviewed and asset management firms would waste valuable time and resources working through large alert queues, performing needless investigations, and reconciling disparate data sources to piece together evidence.

The use of AI and machine learning to capture, extract and analyze several key data elements can help streamline compliance alert systems to near-perfection, thus addressing the problem of false positives. In this way, AI technology can improve the efficiency of compliance operations and reduce costs in today’s data-driven compliance environment.

2. Human error mitigation

There are various causes of human error in asset management – ineffective processes, obsolete technologies, or negligence to name a few. No matter what the cause is, human error costs regulated industries billions every year. Besides, the changing global and local financial regulations require asset managers to continuously track, manage, and analyse data about transactions, customers, and operational activities. This brings the risk of an increase in human error.

When being included in a technology-driven strategy, AI applications can be valuable in mitigating the impacts of human error. AI-powered technologies can detect blind spots, reasonable errors, and other things that humans may not necessarily pick up on.

3. Cost reduction

As we mentioned before, modern asset management firms need to adapt to various regulatory requirements, many of which involve the management and analysis of big data. Bain & Company estimated that governance, risk and compliance costs usually accounted for 15 – 20% of the institutions’ total day-to-day expenses.

Regulatory technology (RegTech) software developers are using AI and machine learning applications to automate complex processes that relied on manual work previously, increasing the efficiency and lowering the costs of compliance. We can expect that this, along with the accuracy gained through effective AI implementation, can save the asset management industry millions in annual compliance costs.

4. Effective regulatory change management

To successfully deal with regulatory change management, asset management firms have to combine content from thousands of regulatory documents. Regulatory changes require adjustments accomplished by cooperation between different areas of the business and have second and third-order effects.

For instance, when asset managers restructure a portfolio based on changes in regulations, each asset within it will be affected, potentially resulting in imperative adjustments in other portfolios. When regulations are updated, these kinds of domino effects will be common. The reporting processes of asset management firms also involve many documents and repetitive tasks.

This is where natural language processing (NLP) and intelligent process automation (IPA) are particularly useful in meeting compliance requirements. Automating the process of regulatory change management is a potential use case of AI. The major issues of asset management firms, including hefty fines for non-compliance, can be addressed thanks to successful AI implementation.

5. Human resource optimisation

Asset management firms have to periodically produce hundreds of reports for various market authorities around the year. Instead of manually performing these tasks every cycle, compliance teams can adopt IPA to spare their time for exception-based handling, resolution of identified errors, inconsistencies and non-compliance, and even for tasks with added-value benefits such as oversight and process management.

In conclusion, although there has not been a one-size-fits-all solution to every challenge and issue asset managers face, well-implemented AI solutions will be a valuable addition to firms’ systems, helping them improve compliance programs substantially.

If you want to learn from a panel of AI and industry experts who will discuss the most pressing issues in data management, governance, and AI usage in asset and wealth management today please take a look here.

About our speakers:

- (Mr) David Hardoon – Former Special Advisor (AI) at Monetary Authority of Singapore, Senior Advisor (AI) at Corrupt Practices Investigation Bureau

- (Mr) Han Wee Tan – Associate Partner at Ernst & Young Advisory

- (Mr) Derrick Liao – Head of Growth at Nexus FrontierTech