By embedding AI, analytics and machine learning at their core, data-driven asset and wealth managers can enhance their abilities to oversee all the financial aspects of their clients.

Data needs to be at the heart of an asset management firm’s strategy today. A true, front-to-back view of data is critical. To better design a more agile operating model, asset managers should confirm that an effective data foundation is in place—one that promotes trustworthy, clean data and a strong governance structure. Yet, 66 per cent of asset managers say that data management is the area of their business most in need of total disruption. A strong data foundation drives the effectiveness of emerging technologies and is a critical factor in unlocking scalability. Without an effective data strategy and data foundation in place, innovation may be constrained, and automation initiatives may run into headwinds.

But with larger and larger volumes of data to get through, this can create a bottleneck that delays results. One option for asset and wealth management firms to speed up the process is to exploit artificial intelligence (AI) to help with data analysis. It’s a concept that some personnel might feel uneasy about, but Tessella‘s analyst Matt Jones, who keeps a watchful eye on the latest industry trends, has some words of reassurance. “AI is there to help the human, it’s not there to govern and provide the answers – it’s there to augment,” he states.

Below are 3 ways in which AI supports asset and wealth management with data analysis:

AI can process a huge volume of data from multiple sources

“Without the right data management strategy, growing data volumes go from a competitive advantage to a company-wide struggle to make it useful,” said Matthew Scullion, CEO of Matillion. As the size of datasets goes beyond what is possible to be handled by hand only, asset managers will require AI support for automation. When being fed with more information, unlike that of other methods which plateau, the performance of AI keeps improving.

With adequate training, it allows asset and wealth managers to utilize information from diverse sources to understand even complex clients’ economic activities. As a matter of fact, its capabilities to absorb valuable inputs and deliver meaningful outputs grow thanks to the availability of huge datasets.

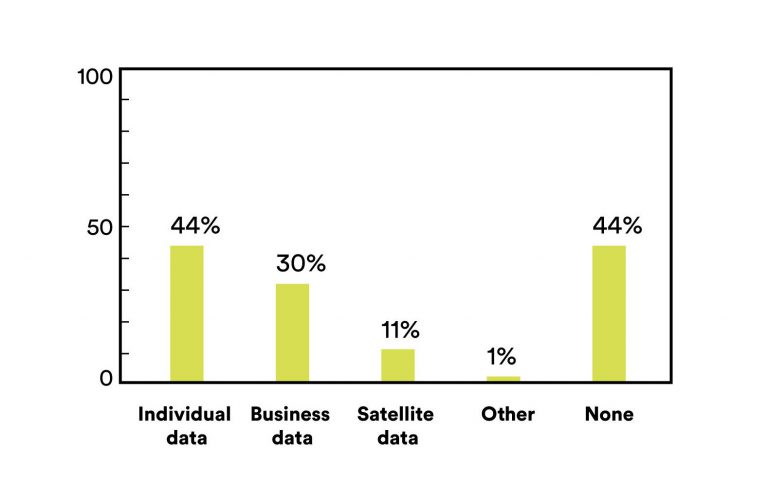

Types of unstructured data Investment Management firms have used for analyses

Source: AI Pioneers in Investment Management (CFA Institute, 2019)

Before AI, many information formats including images, sounds, videos could only be understood by humans. Now trained AI can filter valuable elements within those files faster and better with little to no human intervention. For example, by examining a myriad of financial infographics, industry podcasts, expert interviews, etc., AI algorithms can predict investment trends and opportunities.

AI can provide asset and wealth managers with quality cautions and predictions

Instead of just following instructions coded by humans, as datasets expand, AI algorithms self-adjust through a process of trial, error and cross-checking to produce more accurate prescriptions. By analyzing historical data on risk cases and real-time activities at the same time, AI helps identify signs of potential future issues, therefore provide wealth management with early warnings; besides, thanks to the ability to monitor and manage multiple variables from both structured and unstructured data, it generates higher quality predictions.

As humans are subject to prejudices and assumptions, the quality of a forecast can be fundamentally affected. Warren Buffet once said: “Investing is not a game where the guy with the 160 IQ beats the guy with a 130 IQ. […] You don’t need a lot of brains to be in this business. What you do need is emotional stability.” Here the use of AI in analysis on market data can also help mitigate the wrong conclusions due to human bias. The capabilities of AI would be powerful and imperative enablers of thorough investment decisions and planning.

AI can perform data analysis tasks in a resource-saving manner

AI’s enormous processing power allows not only more accurate forecasts but also data analysis in just a fraction of time that human efforts would take. Given that there are many areas of finance generating large amounts of data and processing it becomes labour intensive and time-consuming, firms with AI deployment supporting data analysis will surely acquire a competitive advantage.

However, while AI can greatly improve the speed and quality of data analysis, it should not and cannot replace human judgement. Its accuracy is simply not at 100% yet. To utilize these new tools effectively, asset and wealth management firms still need experts to play supervising roles. As a result, firms will have to make substantial investments in creating AI strategies with which they can leverage both human and AI resources.

If you want to get support for a human-in-the-loop AI implementation, get in touch with one of our representatives. It would be our pleasure to provide you with consultation on AI solutions for asset & wealth management and help your firm augment your performance.