Why trustworthy AI matters when financial institutions use GenAI to analyse internal data and deliver personalised insights in consumer lending.

GenAI is no longer emerging – it is already helping lenders accelerate internal workflows, from credit assessments to loan servicing. When applied to financial reports, GenAI can summarise lengthy documents, extract key indicators, and flag anything unusual from unexpected figures to missing details in seconds.

But with that speed comes uncertainty. Unlike traditional automation, GenAI often produces results that are hard to explain and inconsistent in quality, which can seriously impact the reliability of decisions made by underwriters and credit teams. That is why underwriters and credit teams are now asking a critical question: Can we trust what the AI generates?

Hyper-personalisation in lending is not about surface-level customer data; it starts with a deep understanding of the borrower’s financials. Consumer lending teams are adjusting credit terms, risk models and product offers based on internal financial data analyses.

However, if GenAI extracts or processes that data with limited oversight or transparency, the results become unreliable. Personalisation fails without trustworthy data and that affects both customer experience and regulatory risk.

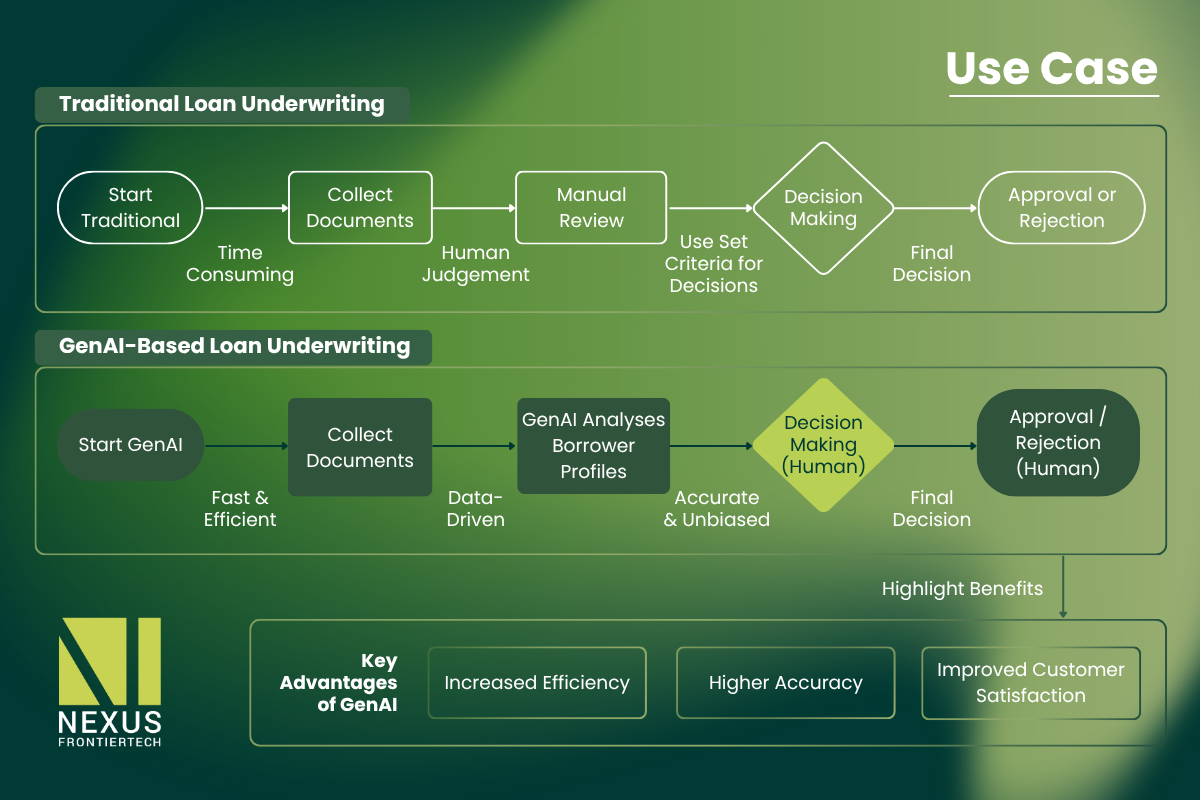

A key use case: AI is transforming loan underwriting by replacing manual reviews with fast, data-driven analysis, boosting accuracy, efficiency, and customer satisfaction in consumer lending.

These are not just technical issues. When credit and risk teams are not sure how reliable the GenAI’s output is, it becomes harder to trust the results or explain them to others. This slows down decision-making, increases risk, and puts pressure on both internal teams and customer interactions.

Many organisations developing or piloting GenAI tools for underwriting are discovering that success requires more than speed, it requires governance. To bring GenAI into production, institutions must pair it with auditability, controls and traceable data flows.

For GenAI to support underwriting at scale, trust must be built into the system from day one. This means knowing where the data comes from, how it is used, and being able to prove it to internal and external stakeholders.

As lenders scale personalised lending strategies, the reliability of the underlying data and GenAI becomes essential.

In Part 2, we look at how data traceability creates the foundation for scalable, trustworthy GenAI personalisation in consumer lending.

Level 39, One Canada Square,

Canary Wharf, London

E14 5AB

6 Battery Rd, #03-62,

The Work Project @ Six Battery Road

Singapore 049909

Studio 1006, Dreamplex Thai Ha, 10th floor 174 Thai Ha Str, Dong Da Ward

Hanoi 100000, Vietnam

Otemachi Building 4th Floor

Otemachi 1-6-1, Chiyoda

Tokyo 100-0004, Japan