The Middle East’s evolving ESG regulatory landscape demands a fundamental shift in how organizations manage risk and report progress. ESG is no longer a static compliance exercise but a dynamic one influenced by investor pressure, regional instability, and global standards like CSRD and ISSB. Current ESG processes in the region often fall short, proving slow, fragmented, and inadequate for this evolving environment.

EY’s 2025 outlook underscores the growing importance of AI-powered risk management in the Gulf’s digital strategies, predicting that ESG and ethical AI integration will be crucial for navigating sustainability and governance. Consequently, ESG risk monitoring must move beyond backward-looking assessments to become real-time, localized, and intelligent.

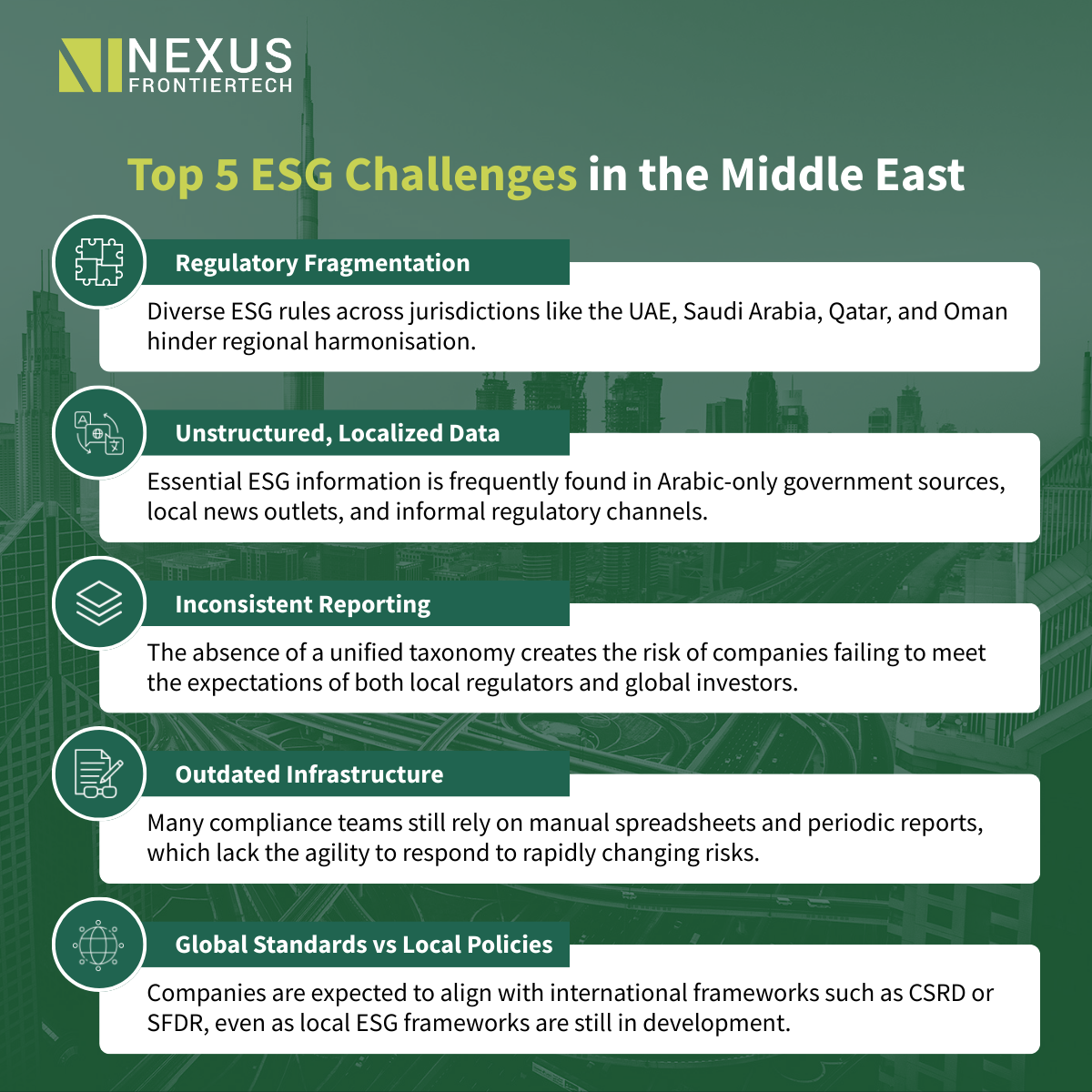

Several structural challenges complicate ESG compliance for organizations operating in the region:

These challenges expose institutions to significant risks, including reputational damage, regulatory penalties, valuation pressures, and limited access to ESG-linked capital.

In the face of real-time ESG incidents, quarterly assessments are insufficient. Emerging risks, such as labor disputes, environmental violations, or policy changes, can remain undetected until significant consequences arise. A company might comply with national ESG guidelines but still fail to meet the transparency requirements of CSRD for European investors.

This discrepancy leads to a “visibility gap,” where ESG risk accumulates without being tracked, managed, or communicated effectively. In a region characterized by increasing investor scrutiny and high reputational stakes, this gap carries substantial costs.

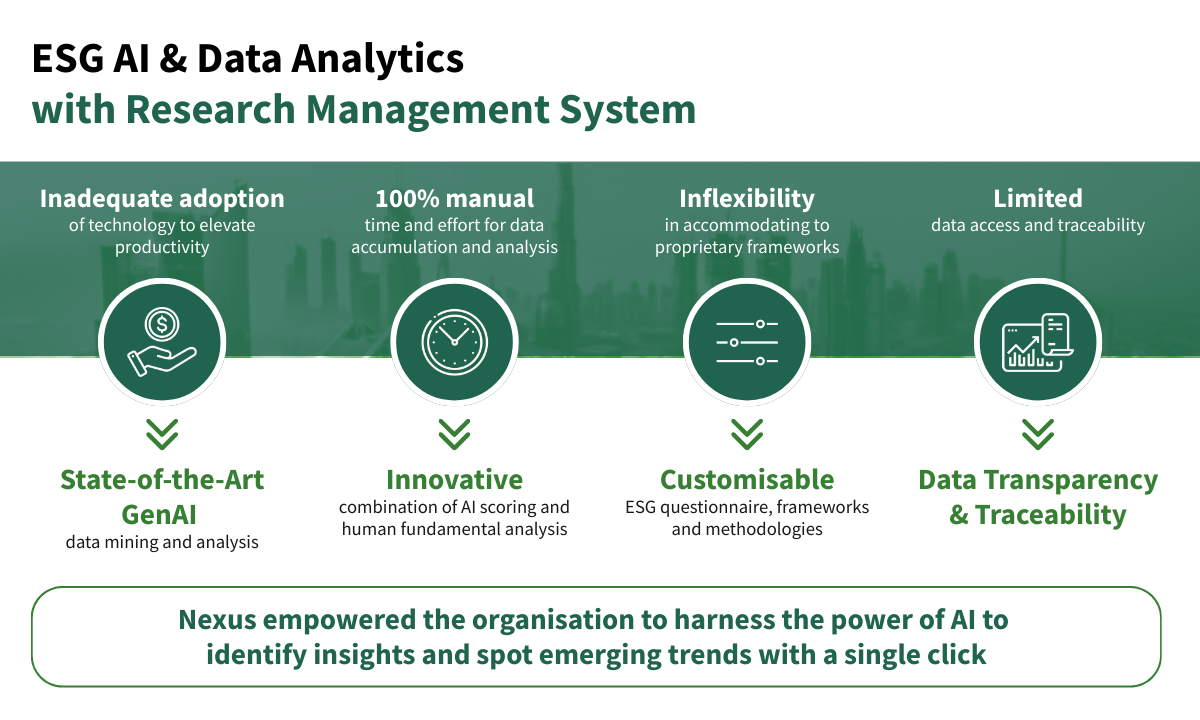

AI offers a viable solution, not to replace human judgment but to enhance capacity, consistency, and contextual understanding.

Platforms like OneNexus empower ESG and compliance teams by enabling them to:

The core advantage of this approach is its adaptability. OneNexus can adjust to evolving regulatory timelines and reporting requirements, whether the goal is compliance with local ministries, alignment with ISSB standards, or preparation for investor due diligence.

The OneNexus platform continuously analyzes and structures ESG data from various jurisdictions into actionable dashboards, allowing companies with operations in multiple markets to:

This level of transparency is particularly critical in the Middle East, where the pace of regulatory change often outstrips the ability of internal policies to keep up.

As ESG becomes a strategic priority in Gulf boardrooms, organizations will require systems that go beyond mere reporting—systems capable of interpreting, anticipating, and responding to dynamic conditions. Static frameworks will prove inadequate in this inherently dynamic region.

Real-time, AI-driven ESG infrastructure is no longer a future aspiration but a present necessity. It equips Middle Eastern institutions not only to keep pace with global sustainability trends but also to become leaders in this crucial global dialogue.

Explore OneNexus: https://onenexus.ai

Level 39, One Canada Square,

Canary Wharf, London

E14 5AB

6 Battery Rd, #03-62,

The Work Project @ Six Battery Road

Singapore 049909

Studio 1006, Dreamplex Thai Ha, 10th floor 174 Thai Ha Str, Dong Da Ward

Hanoi 100000, Vietnam

Otemachi Building 4th Floor

Otemachi 1-6-1, Chiyoda

Tokyo 100-0004, Japan