In a recent article, we discussed how AI is redefining data migration – eliminating downtime and ensuring full traceability across financial systems.

But migration is only the starting point. Once data is transferred, the challenge shifts: How can institutions make sure data moves seamlessly and effectively across platforms, products, and decisions in real time?

In a financial landscape where milliseconds can mean millions, many organisations still rely on fragmented, manual data integration processes. The result? Missed opportunities, increased risk, and regulatory strain.

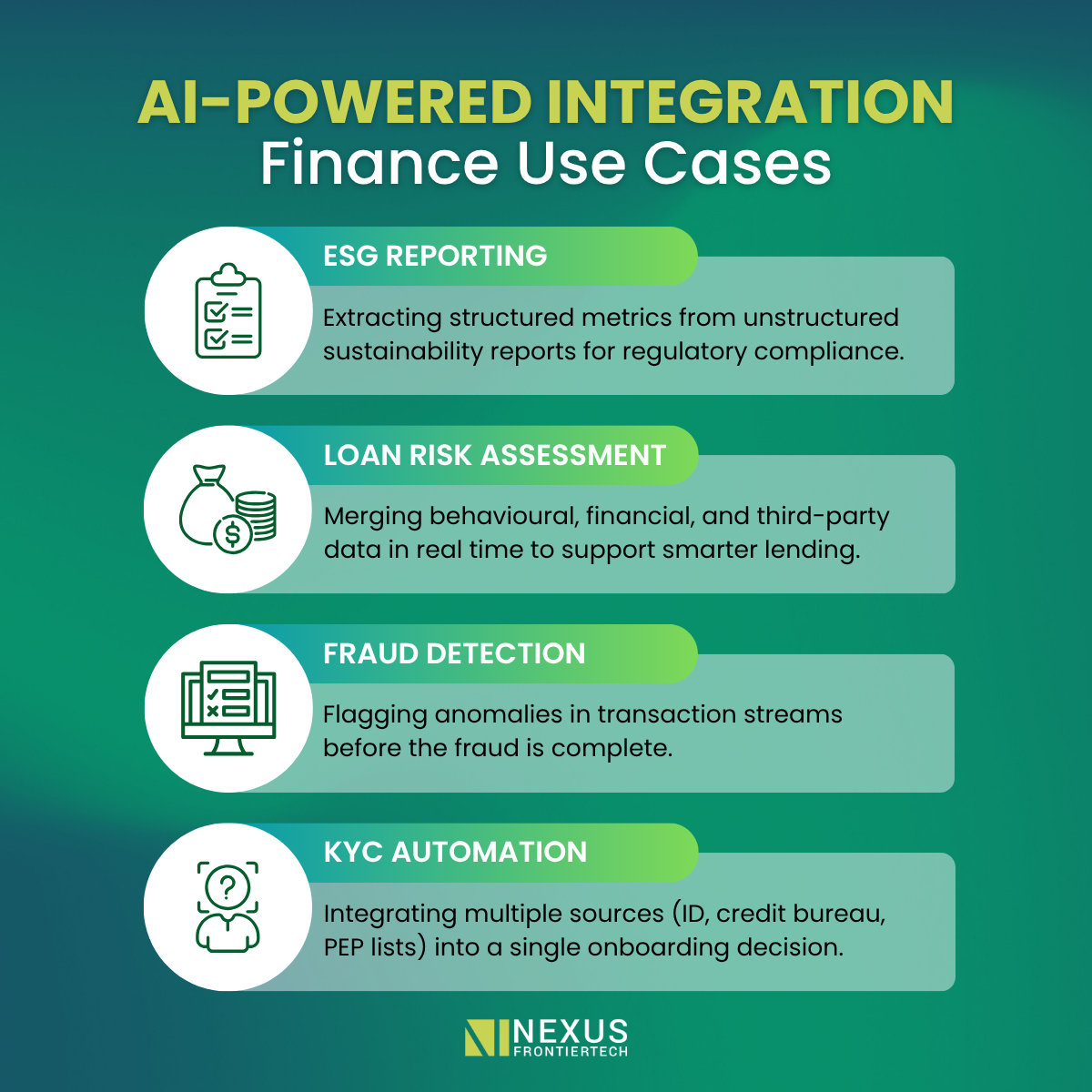

This is where AI-powered, real-time data integration becomes more than a technical enhancement. It becomes a strategic enabler for the modern financial enterprise.

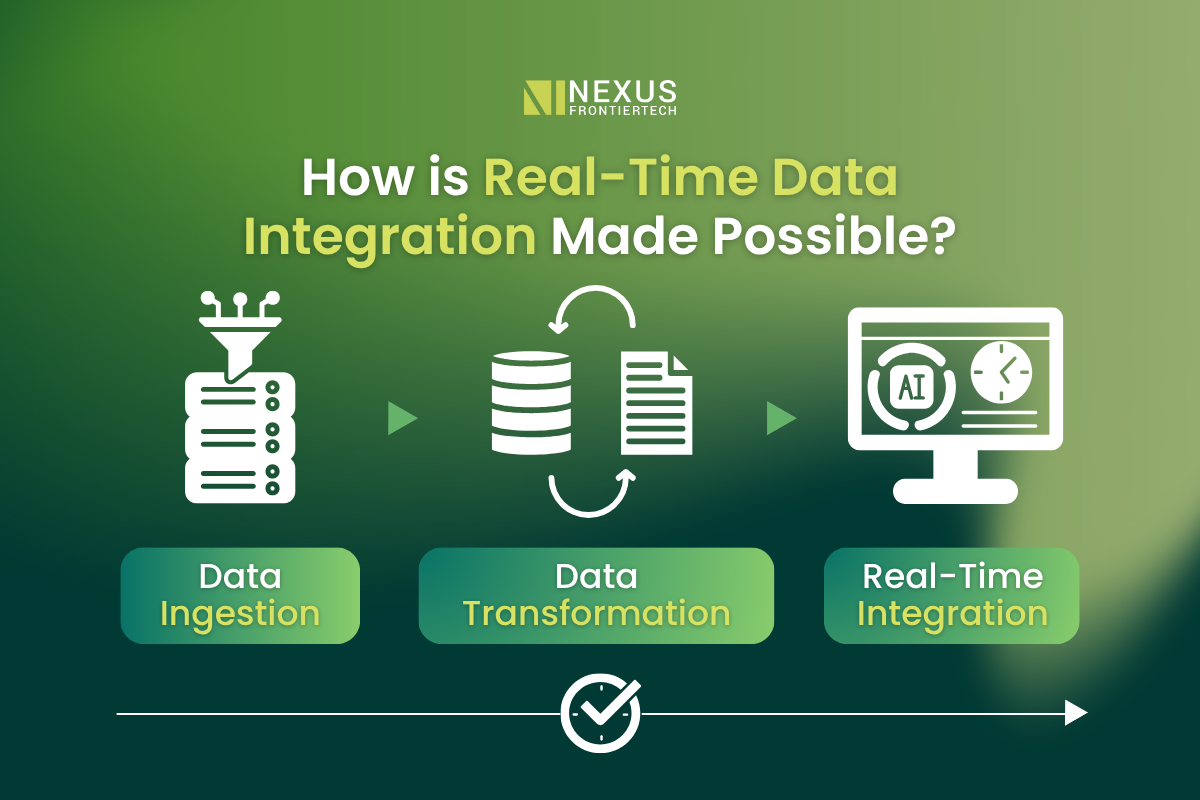

Real-time integration makes data instantly usable across systems. AI powers this flow to enable faster decisions and smarter operations without the delays of batch jobs or manual work.

For banks and financial institutions, this capability translates into:

In essence, AI-driven real-time integration works quietly in the background, ensuring that operations stay responsive, reliable, and aligned with business goals.

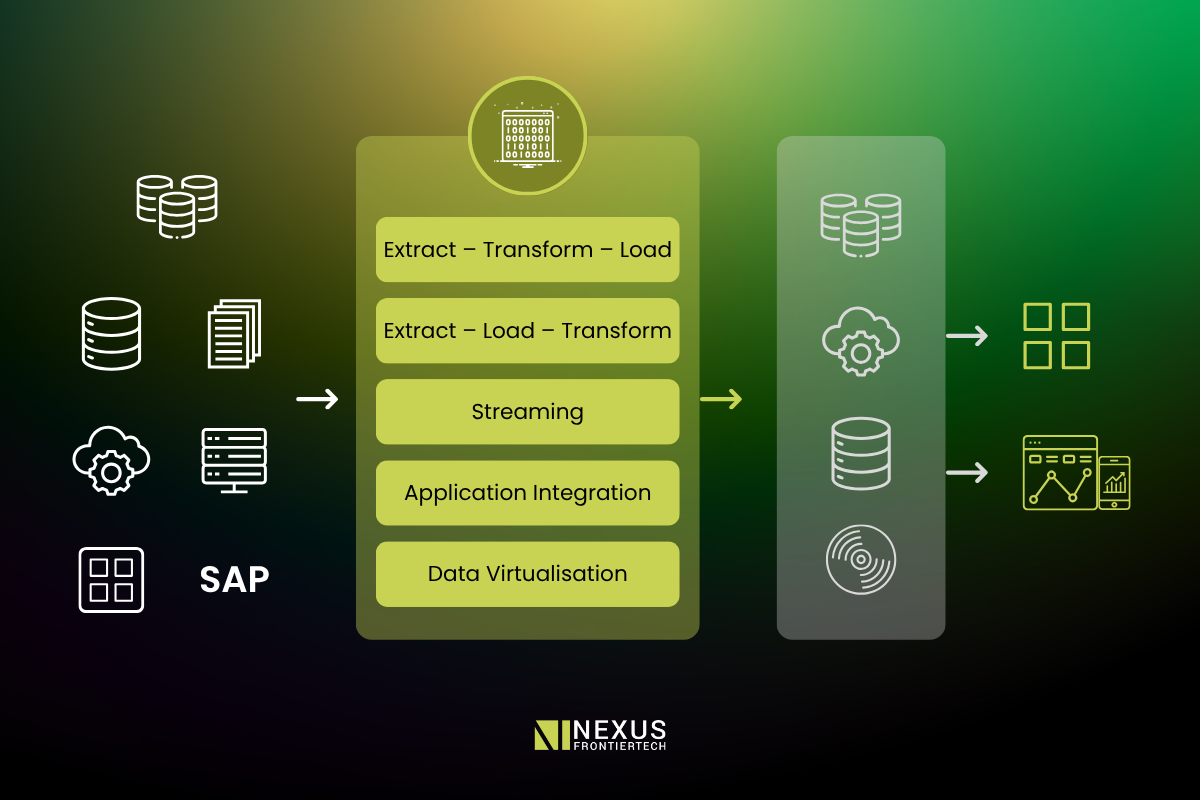

Traditional approaches to data integration are increasingly becoming liabilities. Many organisations still struggle with:

Without automation, even simple system updates can disrupt operations or expose institutions to compliance risks.

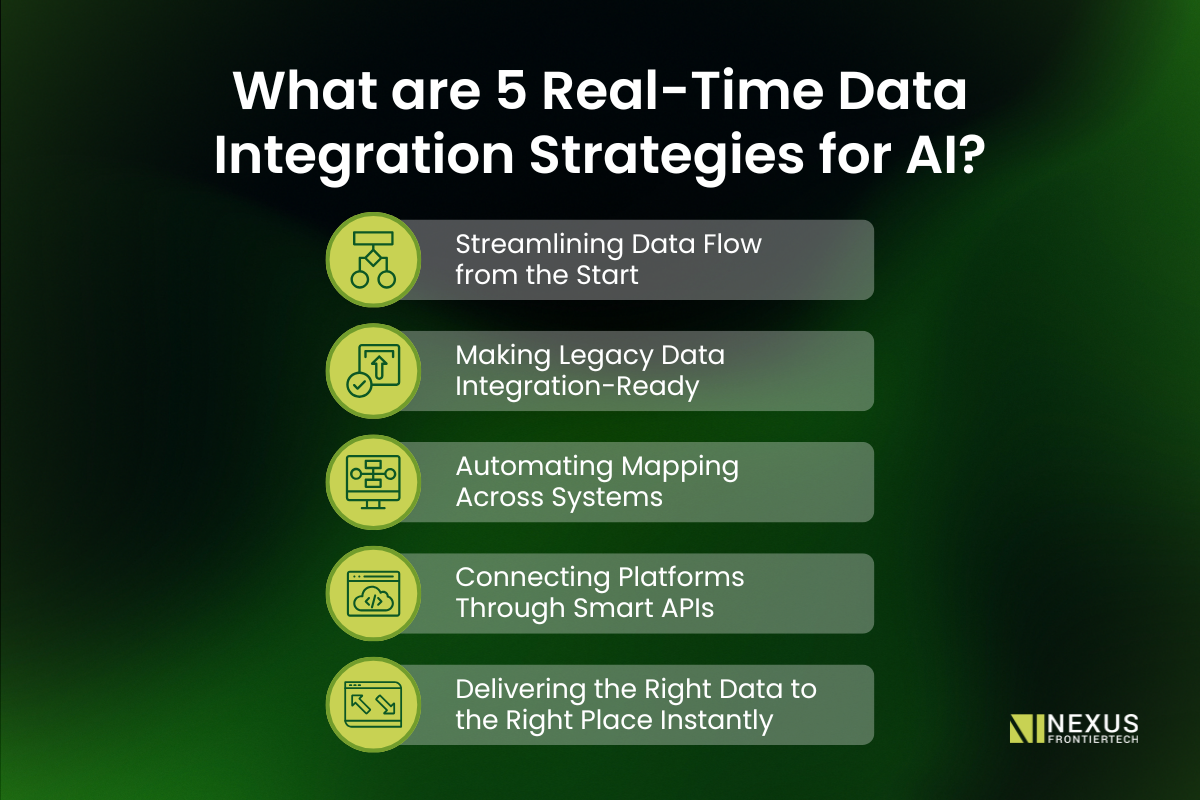

AI is not just another tool in the integration toolbox, it is becoming the central architect of how data flows across the enterprise. By embedding intelligence into each stage of the data journey, AI is reshaping integration as a dynamic, responsive, and strategic capability.

With AI, organisations can:

Platforms like OneNexus from Nexus FrontierTech are already putting this into action with full auditability and zero downtime during data migration and integration.

AI helps standardise how data enters an organisation, from internal systems, external partners, or third-party sources, creating a reliable foundation for integration.

Instead of waiting for manual rework, AI transforms outdated or messy data structures into usable formats on the fly, enabling real-time connection to modern platforms.

AI identifies how data fields relate between systems – automating the mapping process and reducing time, errors and reliance on IT teams.

From core banking to cloud applications, AI simplifies how systems talk to each other, ensuring data flows securely and consistently across business units.

AI ensures that once data is integrated, it reaches the teams, tools, or decision engines that need it – in the right format, at the right moment.

At Nexus FrontierTech, we developed OneNexus to address the specific data integration challenges faced by financial institutions undergoing digital transformation.

What makes OneNexus different:

Whether you are modernising legacy systems or deploying new AI models, OneNexus gives you a secure, real-time foundation to build on.

The next evolution of data integration will be:

AI is not just enhancing data integration – it is transforming it into a competitive advantage.

For financial institutions, real-time, AI-driven integration is no longer optional. It is a necessity for driving faster growth, ensuring better compliance, and making smarter decisions in a world where speed and precision define success.

Interested in making your data work smarter?

Interested in making your data work smarter? Learn more about OneNexus and how we help financial institutions integrate with intelligence.

🔗 onenexus.ai

To explore how AI agents build on this foundation to drive strategic autonomy in finance, join our upcoming webinar Beyond Automation – AI Agents at the Core of Financial Transformation on 24 June. Our speakers – Danny Goh, Terence Tse, PhD and Mark Esposito, PhD will bring real-world insights into how autonomous systems are reshaping financial infrastructure.

Level 39, One Canada Square,

Canary Wharf, London

E14 5AB

6 Battery Rd, #03-62,

The Work Project @ Six Battery Road

Singapore 049909

Studio 1006, Dreamplex Thai Ha, 10th floor 174 Thai Ha Str, Dong Da Ward

Hanoi 100000, Vietnam

Otemachi Building 4th Floor

Otemachi 1-6-1, Chiyoda

Tokyo 100-0004, Japan