In 2025, personalisation in finance has moved far beyond simple product suggestions or segmented marketing. Customers now expect interactions that are immediate, relevant, and tailored to their real-time financial behaviour, whether they are applying for a loan, checking investment risks, or onboarding with a new provider.

However, most financial institutions still struggle to deliver on this promise. Despite advanced front-end platforms, their underlying systems often rely on fragmented data, manual processes, and limited visibility into why decisions are made.

This article explores how personalisation has evolved, why many firms fall short, and what is truly required to deliver scalable, real-time, and explainable personalisation. We also introduce OneNexus, the AI infrastructure that enables financial institutions to turn unstructured data into trusted, decision-ready insights.

Today’s customers expect financial services to be quicker, more relevant, and more personalised: not based on who they were last year, but on what they need right now.

Customers now expect:

The reality: Most banks still deliver a one-size-fits-all experience, powered by outdated systems and data.

Even when banks invest in digital experiences, the back-end processes often remain unchanged. Systems are still reliant on manual checks, static customer profiles, and disconnected data sources. As a result, the ‘personalisation’ many customers encounter is often limited to generic recommendations or delayed responses, far from the tailored, real-time experience users expect.

This disconnect highlights the gap between what institutions intend to offer and what they are technically equipped to deliver. Bridging this gap requires rethinking how data is gathered, processed, and used in real time and across the full customer lifecycle.

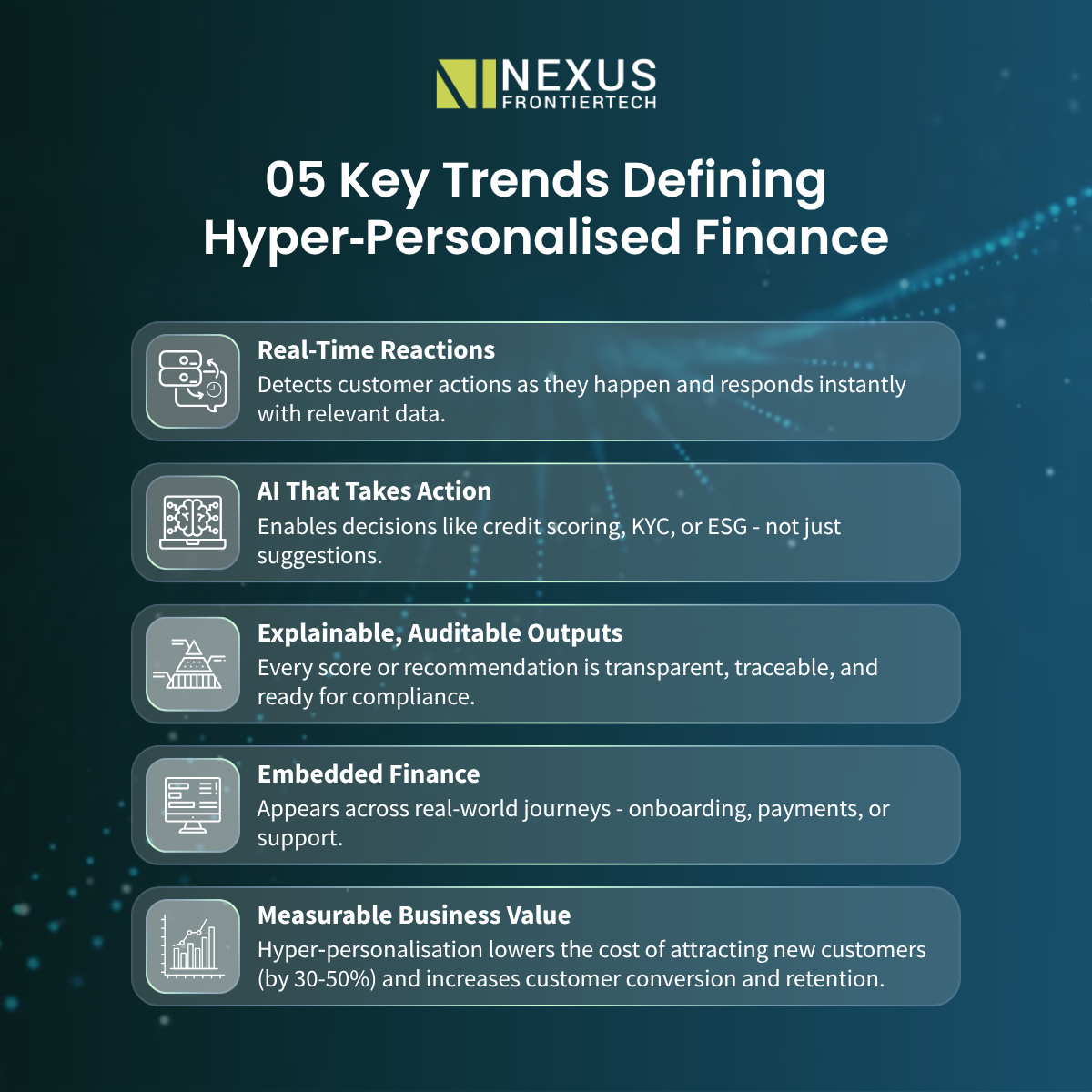

Modern systems must detect what customers are doing in real time and respond immediately with well-informed data-driven actions.

Example: A customer makes a travel booking → the system suggests foreign exchange options or travel insurance.

AI now enables automated decisions – not just product suggestions, including:

With increasing regulation (e.g. The General Data Protection Regulation (GDPR) and the European Union Artificial Intelligence Act (EU AI Act)), financial institutions must explain why decisions were made, particularly those involving credit and risk compliances.

Personalised finance is moving beyond apps, it appears in real-life touchpoints: onboarding flows, e-commerce portals, and even customer service interactions.

Hyper‑personalisation reduces the cost of attracting new customers (by 30–50%) and increases customer conversion and retention.

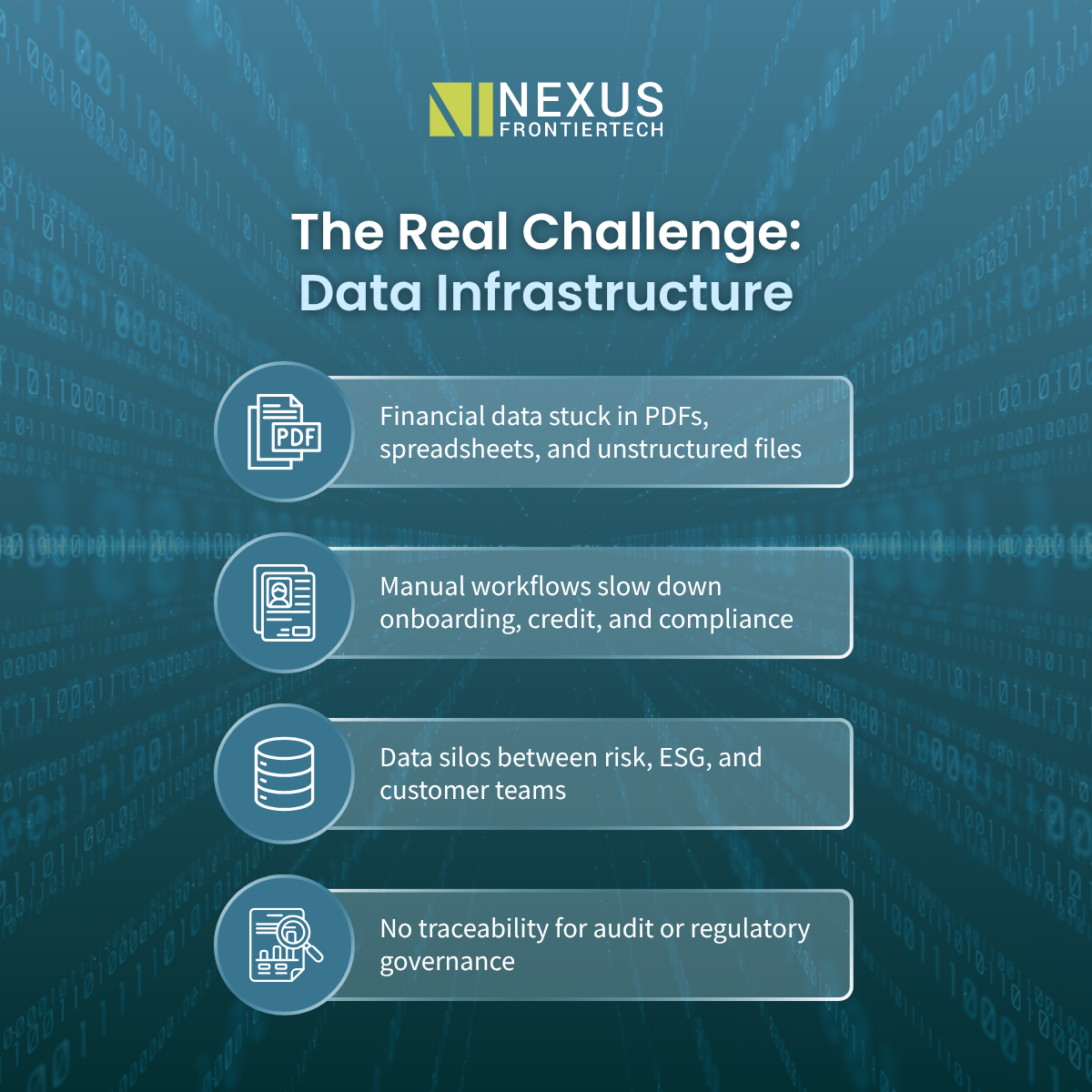

Many banks and fintechs fail to implement meaningful personalisation because of poor data infrastructure.

Despite having access to vast amounts of customer data, much of it remains siloed, unstructured, or outdated. This makes it difficult to generate timely, relevant insights or build consistent, automated processes across departments. Without a unified and trustworthy data foundation, even the most advanced AI or personalisation initiatives cannot operate effectively.

Common challenges include:

OneNexus is not just a tool that extracts data, it helps financial institutions unlock the full value of the information they already have, but cannot use efficiently.

This makes OneNexus especially valuable in high-stakes processes where both speed and compliance matter. Whether assessing SME loans, verifying ESG disclosures, or accelerating onboarding, OneNexus ensures institutions can act quickly – with data they can trust and justify.

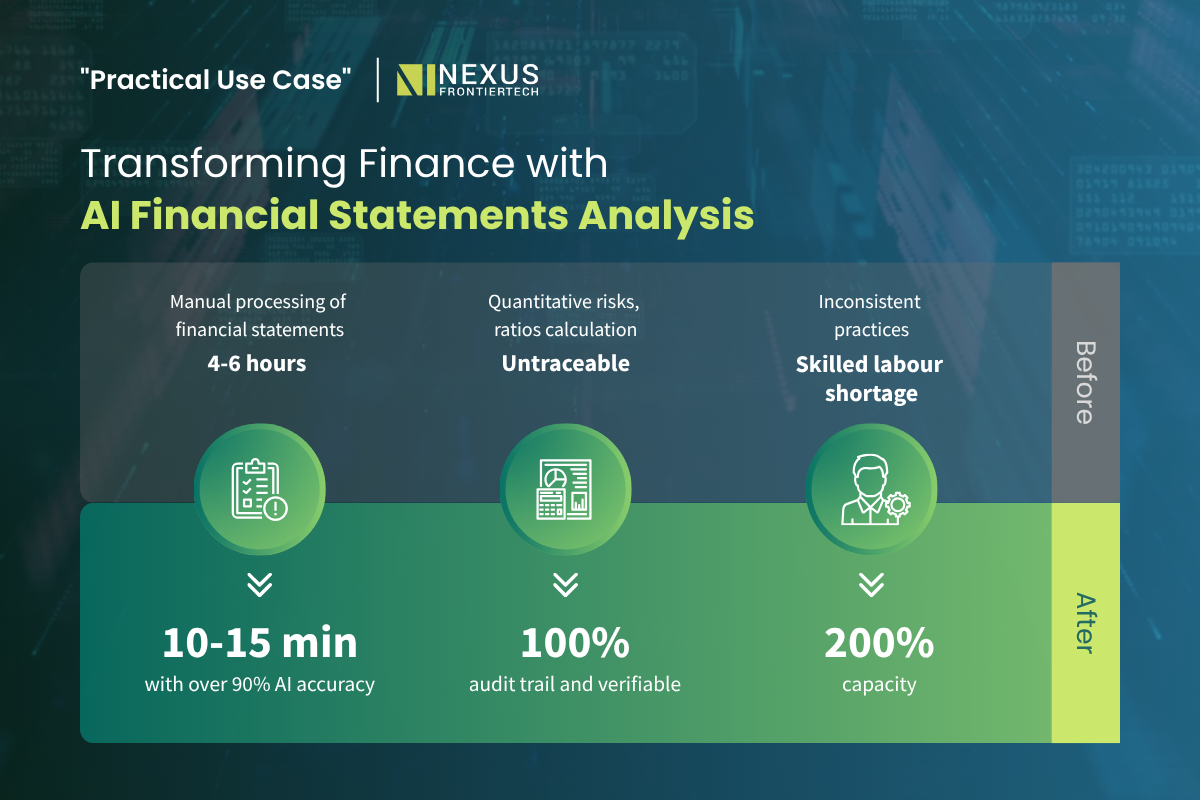

1. Credit Risk Automation – SME Lending

Context:

A leading regional commercial bank in Asia was expanding its SME loan portfolio (under USD 10 million) across multiple markets.

The credit risk team faced significant bottlenecks caused by manual processing of financial statements submitted in varied formats such as PDFs, scanned images, Excel.

Before OneNexus:

After implementing OneNexus:

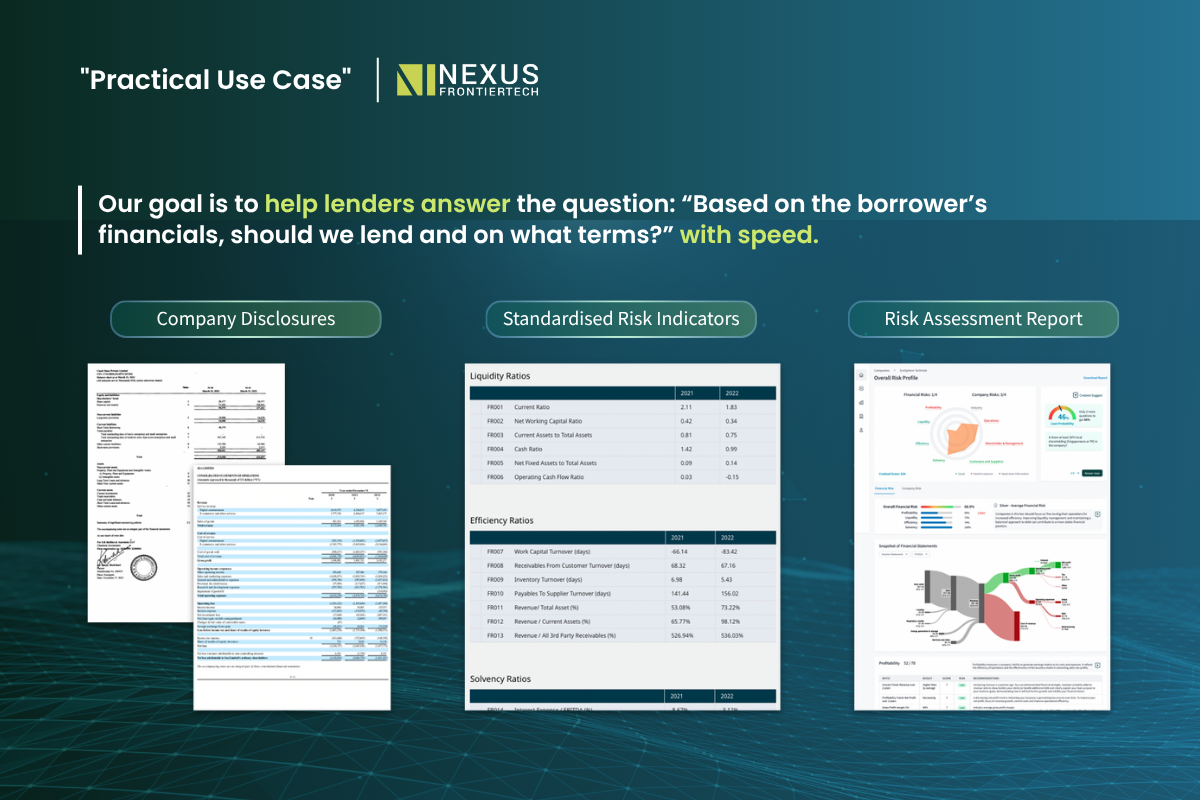

Context:

A global lending platform needed to assess loan readiness for mid-sized private companies using limited financial disclosures.

Speed and accuracy were both critical, especially in competitive lending windows.

What OneNexus delivered:

In 2025, personalisation is not just about improving user interfaces or designing better customer journeys. It depends on something far more fundamental: how financial institutions structure, validate, and manage their data at the core.

Even the most advanced strategies cannot succeed without real-time, accurate, and explainable data. This is the foundation that enables financial firms to move from reactive service to proactive, meaningful engagement.

What institutions truly need is data they can trust, not just to trigger an email or recommendation, but to support decisions that are auditable, compliant, and customer-centric.

With OneNexus, financial institutions can build AI-powered workflows that are responsive, scalable, and fully traceable, turning static information into trusted, decision-ready insights.

See how OneNexus can help your team:

Follow us on LinkedIn and YouTube for more updates, insights, and use cases.

Level 39, One Canada Square,

Canary Wharf, London

E14 5AB

6 Battery Rd, #03-68,

The Work Project @ Six Battery Road

Singapore 049909

Studio 1006, Dreamplex Thai Ha, 10th floor 174 Thai Ha Str, Dong Da Dist

Hanoi 100000, Vietnam

Remote Teams